The Hawaii Wildfires and Protecting What Matters

August 30, 2023

Know When & How to Repay COVID-Distributions

August 30, 2023U.S. Job Growth Slows to a Sustainable Pace: An Analysis for Investors

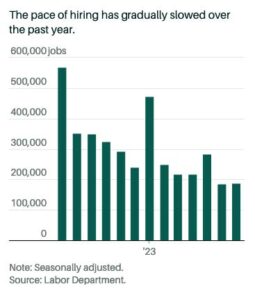

The latest job report reveals a notable slowing in the U.S. job growth as employers added 187,000 jobs in July, which is below economists’ forecast of 200,000 positions. However, investors should not be alarmed as this change is indicative of a shift toward a more sustainable pace and, notably, still exceeds the pre-pandemic monthly average. The July figure is also slightly higher than June’s revised payroll gain of 185,000. This article will delve into what this means for the economy and the implications for investment decisions.

A Shift Towards Sustainable Growth

While the headline number may seem like a disappointment, it’s essential to understand that the reduced pace is a sign of stability rather than weakness. This growth rate is in line with what some economists consider the U.S. labor force can support over the long run, ensuring that growth remains manageable and consistent. It reflects a maturing recovery where employers are carefully aligning job growth with underlying economic fundamentals.

Unemployment Rate and Tight Labor Market

Another encouraging sign is the dip in the unemployment rate to 3.5% in July from June’s 3.6%, against economists’ expectations of no change. This dip further points to a tight labor market where employers are competing for workers, potentially driving wage growth. Such a scenario can lead to increased consumer spending and confidence, fueling further economic growth.

Implications for the Federal Reserve and Interest Rates

Given these figures, it seems unlikely that the Federal Reserve will take future interest-rate hikes off the table. Although the job growth has slowed, the consistent expansion and tight labor market may encourage the Fed to stay on the path of gradual monetary tightening. This could have several impacts on investors’ portfolios, particularly in interest-rate-sensitive sectors like bonds and financials.

Investment Considerations

1. Bonds: With the potential for interest rate hikes remaining, bond investors may want to consider short-duration securities that are less sensitive to interest rate changes.

2. Equities: Sectors benefiting from economic growth and consumer spending may remain attractive, particularly as wage growth may spur more spending.

3. Dollar & Commodities: The outlook on the U.S. dollar and commodities must be closely monitored as interest rate decisions can impact their valuations.

While July’s job growth figures may seem underwhelming at first glance, a deeper analysis reveals a trend toward sustainable growth, accompanied by a tight labor market. Investors should consider these dynamics in their asset allocation and investment strategy, keeping a close eye on potential interest rate movements by the Federal Reserve.

The economic landscape is complex, and an individual’s investment strategy must be tailored to their specific needs, risk tolerance, and financial goals. As your financial advisor, I encourage you to reach out to discuss how these economic trends may impact your portfolio. Together, we can navigate the financial markets to align your investments with the ever-evolving economic landscape. Schedule a meeting with one of our advisors today to learn more!

Copyright © 2023 FMeX. All rights reserved.

Distributed by Financial Media Exchange.