Department of Labor Issues Relief Guidance for Victims of California Wildfires

March 4, 2019

Hey Joel! – My client wants to conduct an RFP for an ERISA attorney, what are important questions they should include?

March 4, 2019All too often, retirement planning success is measured purely by financial metrics: savings amounts (15 percent per year), income replacement ratios (75 percent of preretirement income), or withdrawal strategies (4 percent per year). And the most critical part of planning for retirement is forgotten: the plan itself.

Put another way: how can an employee know how much money they’re going to need in retirement if they don’t know what they’re saving for?

74% of 50-59-year-olds have made a serious effort to plan for the financial aspects of retirement.¹ Only 35% of 50-59-year-olds have made a serious effort to prepare for the emotional aspects of retirement.¹

Visualize Retirement addresses the one planning need that many pre-retirees don’t even know they have: preparing for the non-financial side of retirement.

Three key areas that studies and actual retiree responses indicate are key drivers of happiness in retirement are:

1. Lifestyle: How participants will spend their time in retirement (family, leisure, travel, work, etc.)

70% want to travel

57% want to spend time with family and friends

50% want to pursue hobbies

30% say they want to work

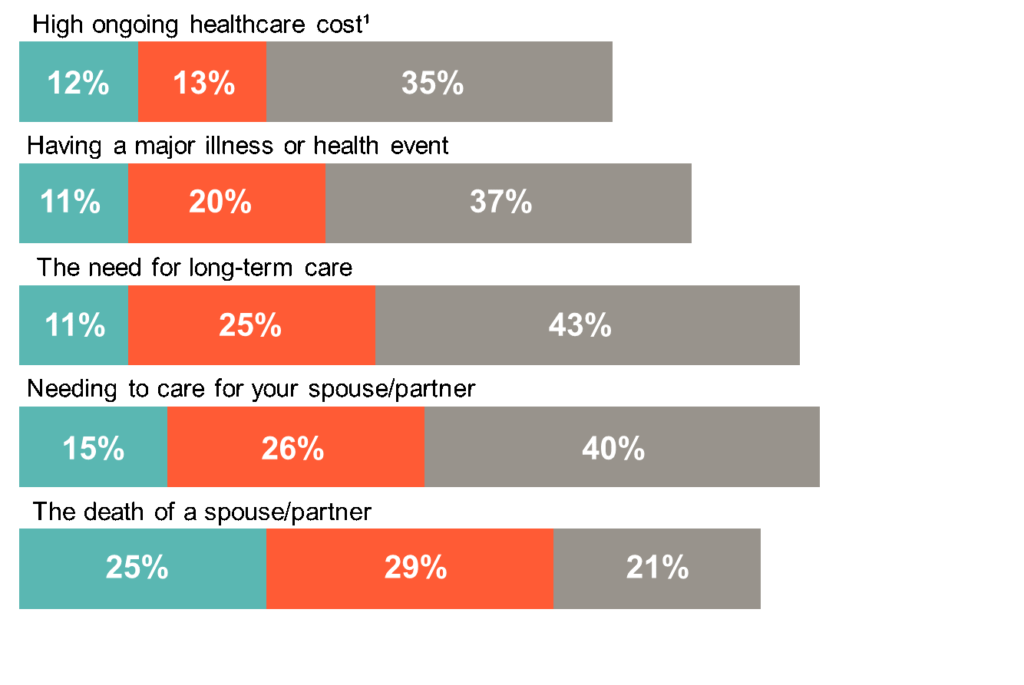

2. Health Care: How participants want to give and receive needed care.

Concern About Personal Events

![]()

3. Meaning: How participants will create a sense of purpose fulfillment

Following almost 1,000 people, a study found that people with “high purpose” were:¹

2.4x Less Likely to be afflicted with Alzheimer’s

Less Likely to develop mild cognitive impairment

Less Likely to develop disabilities or die young

Benefits for Plan Sponsors

Workforce Management Flexibility:

-

- Large amounts of time, money, and resources go to offer and maintain benefits programs that help prepare employees for the next phase of their lives (retirement plans, company matching money, physical/financial wellness programs, healthy incentive programs).

- What happens when the employee – due to a lack of emotional and psychological preparedness-doesn’t end up retiring?

- That backlog can create recruitment and retention issues – as younger talent may seek opportunities elsewhere if A) there is no “foot in the door” position open, or B) they see minimal opportunities to advance internally.

Food for thought: Even if widespread workforce management issues are not prevalent, consider the type of employee that may have a difficult time moving on: the “career-minded executive” whose identity is wrapped up in their achievements and stature within the organization.

Long-term Cost Mitigation:

- As a workforce’s age and tenure increase, so do the costs related to keeping that employee

- An aging demographic – many of whom may not be emotionally prepared to retire – could impact organizational costs such as increased health care, payroll, or worker’s compensation.

To learn more about the Visualize Retirement program and plan sponsor and participant resources associated with it, please contact your plan advisor.

This article is provided by our valued partner, T. Rowe Price.

This article is provided by our valued partner, T. Rowe Price.