We know you are ready for summer! But how’s your retirement plan doing?

July 1, 2022

Have You Met Your Match?

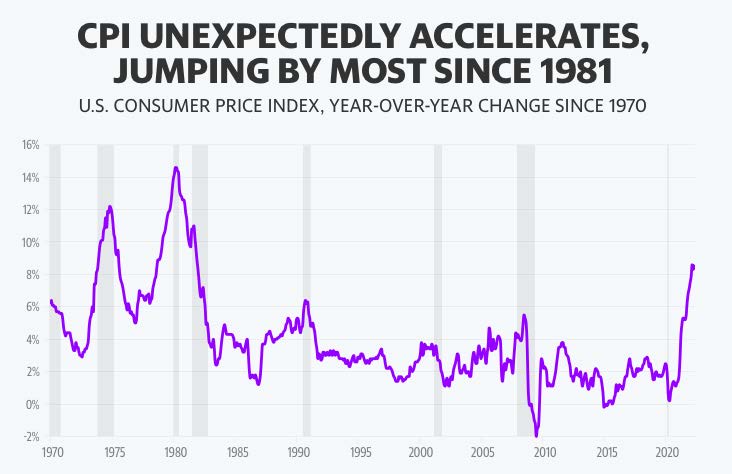

July 1, 2022Largest Increase in Inflation Since December 1981

Your long-term retirement strategies must account for inflation – or else

On Friday, June 10th, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers increased 1.0% in May after rising 0.3% in April. Worse, over the past 12 months, the Consumer Price Index increased 8.6%.

According to BLS, “the increase was broad-based, with the indexes for shelter, gasoline, and food being the largest contributors. After declining in April, the energy index rose 3.9% over the month with the gasoline index rising 4.1% and the other major component indexes also increasing. The food index rose 1.2% in May as the food at home index increased 1.4%.”

Further:

- The index for all items less food and energy rose 0.6% in May, the same increase as in April.

- While almost all major components increased over the month, the largest contributors were the indexes for shelter, airline fares, used cars and trucks, and new vehicles.

- The indexes for medical care, household furnishings and operations, recreation, and apparel also increased in May.

Largest Increase Since 1981

On a 12-month basis:

- CPI increased 8.6% for the 12 months ending May

- This is the largest 12-month increase since the period ending December 1981

- The all items less food and energy index rose 6.0% over the last 12 months

- The energy index rose 34.6% over the last year, the largest 12-month increase since the period ending September 2005

- The food index increased 10.1% for the 12-months ending May, the first increase of 10% or more since the period ending March 1981

Historical Inflation

Inflation in the United States has averaged around 3.3% from 1914 until 2022, but it reached an all-time high of 23.70% in June 1920 and a record low of -15.80% in June 1921.

Most will remember the high inflation rates of the 70s and early 80s when inflation hovered around 6% and occasionally reached double-digits. But so far in 2021 and 2022, inflation seems to have gone up every single month – which you no doubt already know – because you’re feeling it.

Inflation: The Retirement Killer

Inflation decreases the purchasing power of your money in the future and unfortunately, many don’t factor inflation into their retirement plans.

Consider this: at 3% inflation, $100 today will be worth $67.30 in 20 years – a loss of 1/3 its value.

Said another way, that same $100 will only buy you $67.30 worth of goods and services in 20 years. And in 35 years? Well your $100 will be reduced to just $34.44.

What Investors Need to Remember

Therefore, it is imperative that your long-term retirement strategies account for inflation and that you prepare for a decrease in the purchasing power of your dollar over time. You should strongly consider assuming that inflation will be more than 3% – its historical average.

It’s true that inflation today hovers over 8% – quadruple the Federal Reserve’s target inflation rate – but a better assumption might be one based on the last 100-years of data.

If you’re wrong and you find that the inflation rate for the next 25 years turns out to be 2%, then the purchasing power of your retirement savings will be more, not less.

Your financial advisor can create models with various inflation scenarios so you can better understand – and account for – inflation’s true impact to your retirement. Click here to meet with a Duncan Financial Group personal advisor that’s right for you.