Why You Need Life Insurance

January 28, 2022

What is an appropriate interest rate for plan loans?

February 9, 2022Coming into 2022, inflation has been one of the prominent headlines investors and consumers have been trying to get their arms around. The Fed has officially executed the “pivot” on monetary policy, bowing to Wall Street’s demands it get serious about soaring prices and corresponding consequences. The unanimous decision to step up the pace of pulling back the massive bond buying, along with telegraphing how it stands prepared to hike rates as many as three times in 2022, has taken some by surprise and led to the volatility we’ve seen recently.

Just a few short weeks into the year, the 10 Year Treasury has reached 1.8%, it’s highest level in 2 years, while the Nasdaq has already seen a 10% correction from it’s highs. The S&P 500 and Dow Jones Industrial Average find themselves in the red as well. Cryptocurrencies and other risk assets have gone deeper into the red thus far, further solidifying the change in sentiment from just a few months ago.

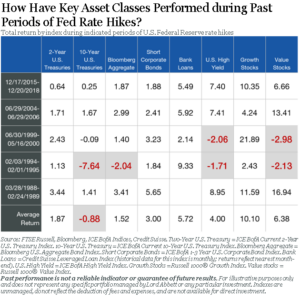

The growth versus value debate is heating up once again, with a rotation away from growth stocks after a long run of out-performance. The inflation trendline and rate hikes have implications for our investment strategy. The playbook continues to evolve – while recognizing the echoes of the past (see the chart below) and what has worked in similar environments, we form our focus of assets classes and strategies that reflect the current dynamics:

In this environment, we continue to emphasize dividend paying equities with a focus on consumer staples, utilities, telecommunications and pharmaceuticals – those categories and companies that enjoy relative stability in their business model while also weathering the inflationary environment with pricing power. At the same time, we will continue to be selective on the growth side of the ledger, recognizing the low rate environment party may be over for companies and sectors in the growth space that have not yet proven themselves to the marketplace. From a fixed income perspective, remaining diversified, favoring the sectors that tend to work in the rising rate world and keeping duration relatively short will be prudent.

Our view is that prices will begin to moderate as we move through the first half of 2022, and interest rates will move higher on stronger growth and Fed tightening. CPI could end this year still higher than 3% however, more of that increase will be driven by the pass-through of stickier costs, such as wages and healthcare, rather than shipping costs and port delays. Volatility will increase as investors assess the Fed’s intentions, and history reminds us that equities often trade down ahead of a tightening cycle, rather than at the peak of it.

Longer term, our view is that innovation and exposure to areas of the global economy aided by secular tailwinds create the best opportunity for investment – even if the prospects seem dimmer on a relative basis in the near term for certain industries and sectors within that universe.

Uncertainty and periods of volatility like these can test the mettle of any investor. We are here to help and are available to discuss your plan and manage through all that’s next together. Thank you for your trust and confidence!

Brian Duncan, CFP®, CLU®

President, Investment Advisor Representative

Private Wealth Management

311 Main Street, Irwin, PA 15642

TF 800.762.5413 P 724.863-3287 x3102 F 724.864.2007

www.duncangrp.com

Click the calendar icon to schedule a meeting

#361077