Stretching the Match

July 11, 2025

The Rise of Thematic and Active Investing in 2025

July 25, 2025Don’t Leave Your Retirement Behind

Starting a brand new job is exciting and full of a lot of new benefits, but don’t forget about the retirement plan you left behind.

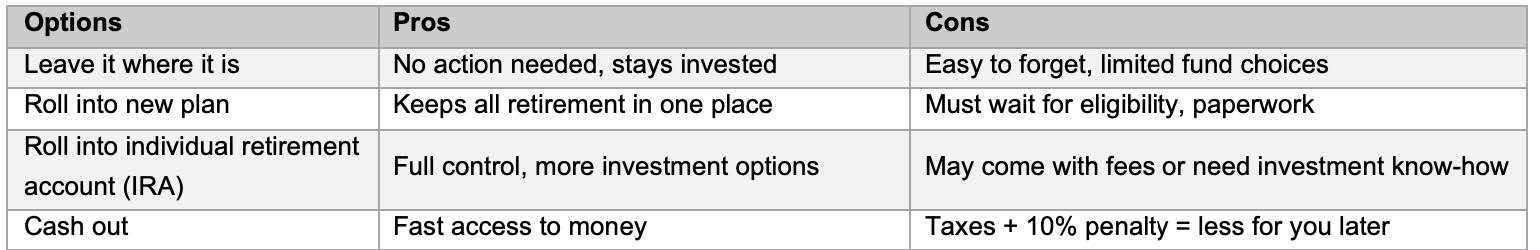

There are many different ways to handle an old retirement account and here are your four options:

Which Option is Right for You?

While there isn’t any definite answer, there are a few things you should consider before moving your old retirement plan. First,

are you happy with your old plan’s performance? Has it grown since you first invested in it? Second, is your new plan better in

terms of features and fees? Would it be worth moving it over? And lastly, do you prefer simplicity or control? Meaning, would

you rather not worry about it and leave it in its current plan or move it somewhere that you can control its investments and

outcome?

How to Take Action

Before you decide what to do with your plan, it’s worth taking a look at your balance. Log into your old plan and check the

balance, especially if you are contemplating cashing it out. Once you’ve decided which route to take, contact your new

Human Resources or plan provider and ask about the rollover process. They will be able to assist and guide you through this

process.

Just because you changed your job doesn’t mean you need to change your retirement goals. Your retirement deserves to

move with you, wherever you’re headed next.

To learn more, schedule a meeting with one of our financial professionals today.