Your Plan Fiduciary Must-Do and Should-Do Lists

March 28, 2023

As Volatility Increases, So Does Retirement Worry

March 31, 2023Putting More Money in Your Wallet

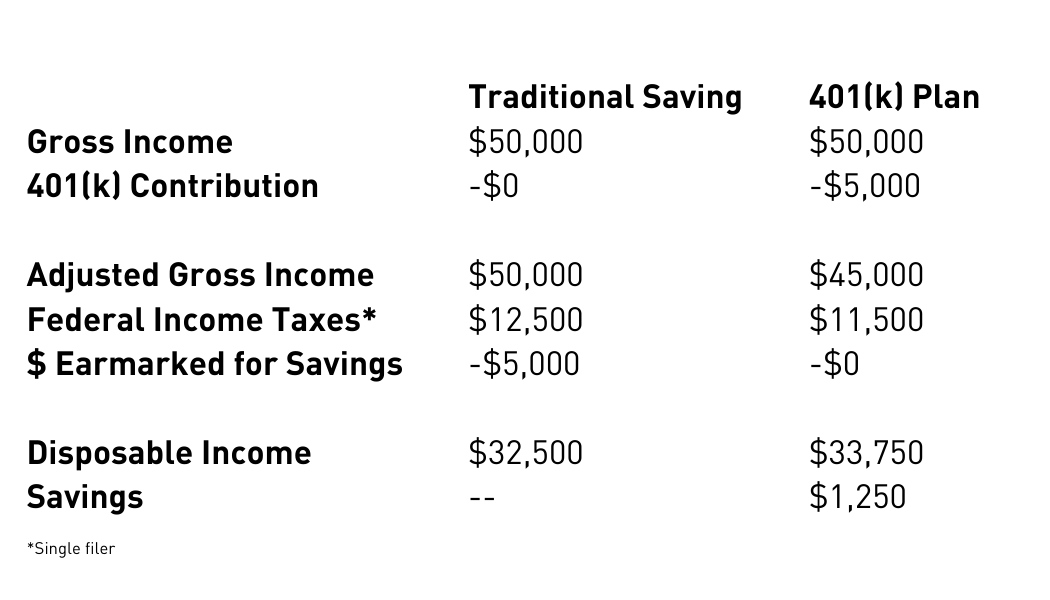

Did you know that how you save your money can affect your bottom line? For instance, if you’re eligible, placing a portion of your pre-tax earnings into your company’s qualified retirement plan (e.g., a 401(k) plan) can increase your disposable income in addition to providing you with the opportunity to save for retirement. Here’s a hypothetical example of how it works.

Bill Walsh is a single taxpayer who has an annual salary of $50,000. He consistently saves $5,000 per year and places it in a bank account. Recently, he became eligible to contribute to his company’s 401(k) plan. Now, instead of making after-tax contributions to his savings account, Bill decides to make a pre-tax contribution of $5,000 into his 401(k). As a result, Bill reduces his taxable income to $45,000. Assuming a 25% federal income tax rate, such a strategy will give Bill $1,350 more in after-tax income. The following chart shows the details.