Mistakes to Avoid When Hiring a Financial Advisor

November 19, 2020

Naughty or Nice: Is there a financial reward for acting ethically?

November 25, 2020This year looks to be a record year for capital gain distributions

When an investor sells a stock for more than the purchase price, the investor experiences a capital gain (it is simpler to call it a profit, but let’s stick to some technical terms for a minute). For example, if you bought Amazon at $2,000 back in July of 2019 and sold it for $3,000 in November of 2020, the capital gain would be $1,000.

Mutual funds operate in much the same way, although it gets a little more complicated. When a mutual fund sells a stock for a profit, it too receives a capital gain and is required by law to pay most of the gain to its shareholders in the form of distributions – after deducting the fund’s operating expenses.

Short- and Long-Term Cap Gains

There are two types of mutual fund capital gains – short-term and long-term.

If the mutual fund – not the mutual fund investor, the mutual fund itself – has held the stock for more than one year, then the profit from the sale is treated as long-term capital gain, which is subject to a maximum of 20% tax rate for mutual fund shareholders. On the other hand, if the mutual fund has held the stock for less than one year, then the profit from the sale is treated as short-term capital gains and is then taxed at the fund investor’s ordinary income tax rate.

Estimates are Out

Mutual fund firms usually begin estimating and publishing their capital gain distributions in the fall and then make final distributions before the end of the year. You should know that mutual funds don’t all make distributions on the same day – they just need to do so before December 31st. And to help you keep track of the distributions and whether they are short- or long-term, mutual funds report this information to shareholders on IRS Form 1099-Div after the end of every year.

Given all this, investors should be aware of purchasing mutual fund shares right before the mutual fund makes a distribution – a term called “buying the dividend.” Generally speaking, investors planning a large lump-sum investment in a mutual fund through their taxable account should avoid buying-the-dividend.

Finally, it is also important to note that there are four types of mutual fund distributions that have tax implications for investors – capital gains, ordinary income (ordinary dividends), qualified dividends, and non-dividend distributions (often called the return of capital). As such, it’s important to discuss the implications of mutual fund investing and taxes with your financial advisor.

What Will 2020 Bring?

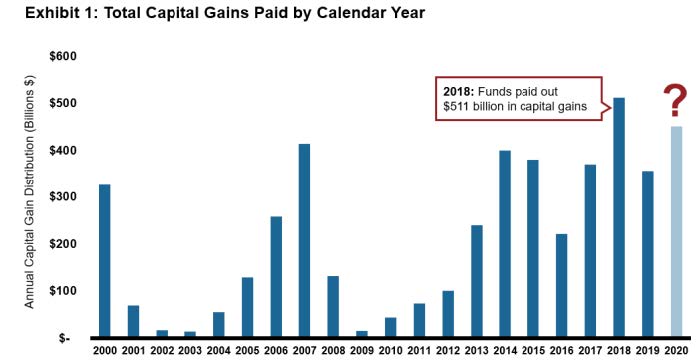

By most estimates, investors will likely see a record year for taxable distributions tied to capital gains. While we won’t of course know how much will be distributed this year, history can provide us an idea. According to data from the Investment Company Institute, mutual funds paid out total capital gains of $511 billion and $355 billion in 2018 and 2019, respectively.

Why was 2018 so much greater than in 2019? Well, part of the reason was that in 2018, investors saw a lot of volatility. Further, there was a lot of selling pressure on mutual funds, especially towards the end of the year. Remember that the S&P 500 ended 2018 down 4.38% and during the months of October and December of that year, the S&P 500 lost 6.84% and 9.03%, respectively? Those declines placed a lot of selling pressures on mutual funds.

In addition, investors have moved out of equity mutual funds into money market funds dramatically in 2020, placing more selling pressure on equity mutual funds (that need to sell in order to meet redemptions, thereby triggering gains).

According to the ICI, from January 2020 through September 2020, investors:

-

- Moved $446 billion out of equity funds and

- Moved $761 billion into money market funds.

Interestingly, those are about double the numbers from the same period in 2019, when investors moved $220 billion out of equity funds and moved $370 billion into money market funds.

What Should You Do?

There are a lot of things you can do to position your portfolio properly amidst what could be a record year for capital gain distributions.

The first thing is to simply be aware of the estimates provided by mutual fund companies. Then you might consider certain strategies, including what is called “harvesting losses.” Your financial advisor can help you determine what your impact might be this year and help you design a course of action that is consistent with your overall financial plan.