HR Tip: Boundaryless recruiting drives committed employees to leave jobs

May 25, 2022

Warren Buffett on How to Protect Against Inflation

June 1, 2022We would first like to wish you a Happy Memorial Day and send a special thank you to all of those who have served in the armed forces. We are incredibly grateful for those who have made the ultimate sacrifice so that we can enjoy the opportunities and freedom that so many around the world do not.

As we reflect on the state of the country and the world, it’s important to remember the difficulties we’ve overcome while acknowledging the challenges we are currently facing. The market has served up a slice of humble pie as many saw the upward trend since the March 2020 bottom as continuing into perpetuity. Economists, market commentators and other prognosticators point to the storm clouds gathering and the inevitability of a recession and potentially stagflation, the term for uncontrolled inflation and slowing or negative economic growth.

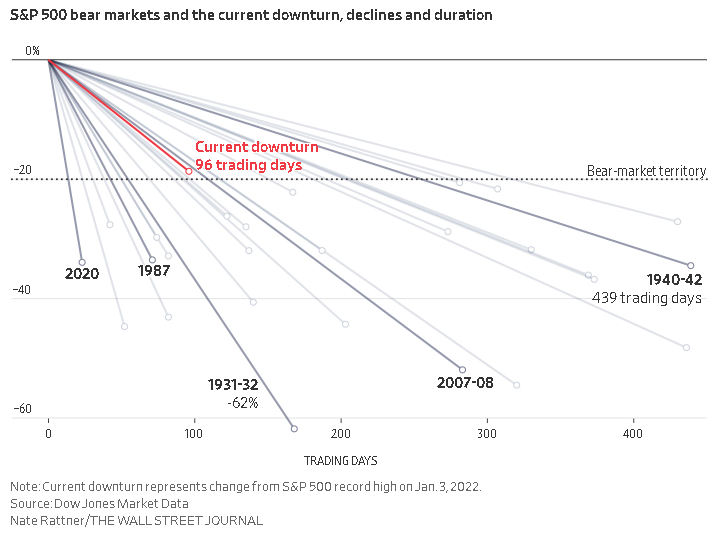

We acknowledge that so much depends on the Federal Reserve’s fight against inflation, which has only been made more difficult by the Russia-Ukraine War and lockdowns in China. As the market seemingly predicts a hard landing, there is a compounding effect – our brains are hard-wired to avoid loss. Studies have found the pain of loss is far more powerful than the pleasure of gain: loss aversion. It’s been a driver in this year’s bear market, becoming a self-fulfilling prophecy in a way. Each occurrence of a bear market feels different given the reasons behind it, resulting in different trajectories in both depth and number of trading days:

It’s important in our view to recognize the gravity of the situation. Rick Rieder, Chief Investment Officer of Global Fixed Income at Blackrock, recently said “My stomach is churning all day” relating to the uncertainty of the issues we face and the potential impact on bond assets. We continue to evaluate bond positions and implement bond alternatives given the headwinds of the rising rate environment and fixed income. Being strategic relative to fixed income is arguably more important than ever and while the landscape has shifted quickly with rising rates, we’ve had ample time to prepare and stay focused on lower duration holdings. Dividend equities, which we’ve emphasized coming into 2022, can be attractive income sources alongside lower volatility holdings.

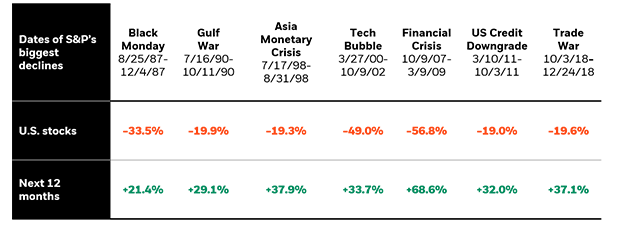

Relative to the equity markets, it’s important to note know that historically, stock market downturns are often followed by a period of positive market performance. Since 1987, every major decline in U.S. equities has reversed itself between 21% and 68% within the following year:

As challenging as it is to see the value of accounts and wealth decline, it is something we’ve experienced before, planned for, and most importantly – overcome before. As your partner on the journey to your financial goals, we keep the plan front and center. Our team will continue to be opportunistic with the buying opportunities that are presented. Don’t hesitate to reach out to us as we push through the turbulence ahead. Thank you for your trust and confidence!

Brian Duncan, CFP®, CLU®

CEO, Investment Advisor Representative

CEO, Investment Advisor Representative