The Philadelphia Eagles vs. Kansas City Chiefs

April 21, 2025

Start Preparing for Your Future Caregiver Today

April 21, 2025Mom & Pop are Quietly Shaping Housing Market

Their powerful influence underscores the evolving nature of real estate

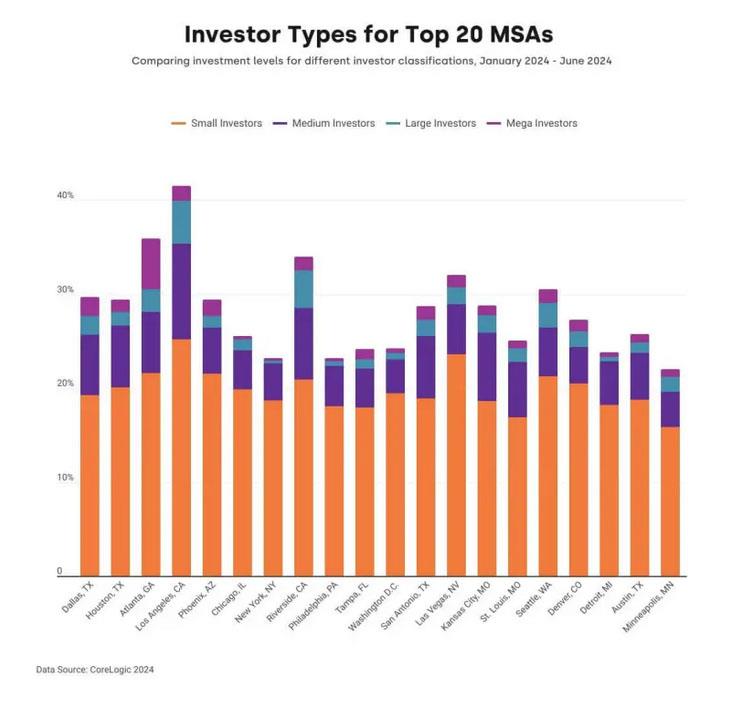

Over the past few years, a quiet yet transformative trend has emerged in the housing market: the rise of mom-and-pop investors. While institutional buyers often dominate headlines, new data from CoreLogic’s Q3 2024 report highlights a different reality. It reveals that smaller-scale investors are playing an increasingly significant role in shaping the housing market.

A Shift in Investor Dynamics

CoreLogic’s report underscores a noteworthy distinction: while institutional investors garner significant attention, they account for only a small fraction of overall investor activity. Instead, most real estate investors are mom-and-pop landlords – individuals or families who own three to ten properties. These smaller-scale investors have steadily grown their presence, reshaping local housing markets and creating ripple effects that influence national trends.

The Role of Mom-and-Pop Investors

Stabilizing Home Prices

One of the most impactful contributions of mom-and-pop investors has been their ability to stabilize home prices. Despite softened overall demand in the broader housing market, these smaller-scale investors continue to purchase properties, providing a crucial buffer against price declines. Their activity supports home values in neighborhoods that might otherwise experience stagnation or depreciation.

S

Filling Rental Demand

As housing affordability challenges persist, demand for rental properties remains strong. Mom-and-pop investors are meeting this need by acquiring and maintaining properties for long-term rental use. Unlike some institutional players who prioritize short-term profits or large-scale developments, these smaller landlords often focus on sustainable, community-centric approaches, enhancing the quality and availability of rental housing.

Contributing to Market Liquidity

Smaller investors also contribute to market liquidity by engaging in frequent property transactions. This activity helps keep the housing market dynamic, creating opportunities for buyers and sellers alike. By purchasing properties that might otherwise sit vacant or unsold, mom-and-pop investors play a vital role in maintaining a healthy flow of real estate activity.

Why Mom-and-Pop Investors Are Growing

Several factors have contributed to the rising influence of smaller-scale real estate investors:

-

1. Accessible Financing: Lower interest rates in recent years have made it easier for individuals to obtain financing for investment properties.

2. Technological Tools: Platforms like Zillow, Redfin, and other real estate tools provide smaller investors with insights and resources previously available only to institutional players.

3. Portfolio Diversification: Many individuals are turning to real estate as a way to diversify their investment portfolios and hedge against market volatility.

4. Post-Pandemic Shifts: The pandemic’s economic impact spurred many to seek new income streams, with rental properties offering a steady source of cash flow.

Implications for the Housing Market

The increasing presence of mom-and-pop investors carries several implications for the broader housing market:

-

• Competition for Entry-Level Homes: Smaller investors often target affordable, entry-level homes, which can create additional competition for first-time buyers. This trend underscores the importance of policies that balance investor activity with the needs of individual homebuyers.

• Localized Market Impacts: Unlike institutional players, mom-and-pop investors tend to focus on specific neighborhoods or regions. This localized approach can lead to disparities in housing market dynamics across different areas.

• Resilience During Economic Uncertainty: These investors have shown resilience during periods of economic uncertainty, helping to stabilize markets when other buyers retreat.

Looking Ahead

As we move further into 2025, mom-and-pop investors are likely to continue shaping the housing market in profound ways. Their quiet yet powerful influence underscores the evolving nature of real estate investment and its impact on housing affordability, market stability, and community development.

For real estate investors, understanding this trend is essential. Whether you’re a seasoned professional or just starting your journey, recognizing the growing role of mom-and-pop investors can help you navigate this dynamic market and uncover new opportunities.

Copyright © 2025 FMeX. All rights reserved.

Distributed by Financial Media Exchange.

To learn more, schedule a meeting with one of our financial professionals today.