Simple Secrets for Retirement Success

March 2, 2020

February Employee of the Month- Geonette

March 9, 2020As of February 28, 2020, global stock markets have entered “correction” territory, defined as a 10% decline from the index high. This is in large part due to the uncertainty surrounding the new coronavirus, first detected in Wuhan City, China, but now detected in 37 locations internationally, including the United States. There certainly will be an economic impact, as growth slows due to quarantines, less consumer traffic, and lower factory output, but it is still to be determined its final result on global growth. Stock markets, however, do not like uncertainty. As uncertainty has grown around this new coronavirus, the resulting fear has led to a quick and notable downward movement in the market.

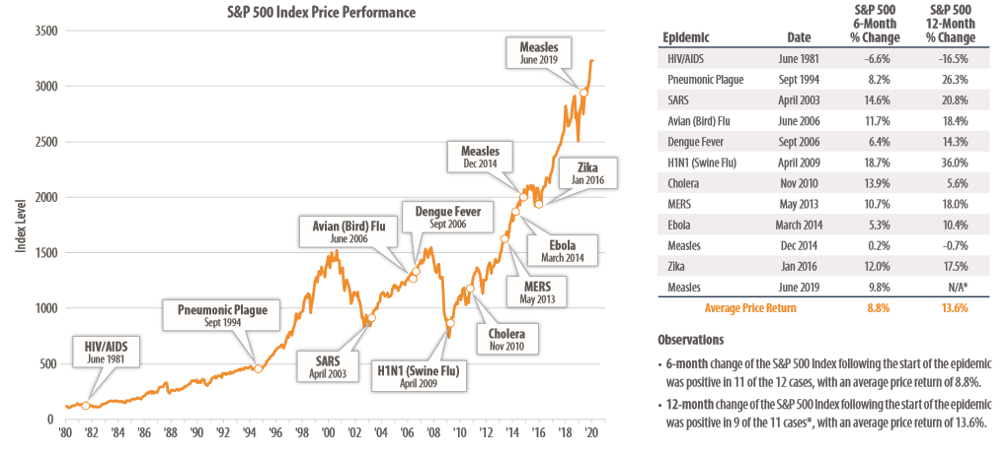

Epidemics in the past have also led to sharp pull-backs in the markets. Over the long-term, however, the stock market has weathered past epidemics. The below chart looks at the historical returns of the S&P 500 Index during multiple epidemics over the last 40 years. Over the 6 and 12 month periods following an epidemic, the S&P 500 performance has, on average, been positive.

During times of uncertainty and market volatility, while it is prudent for plan participants to “stay the course”, it is also prudent for them to review their investment strategies to ensure they are on the most appropriate path.

(e.g., “What is my risk tolerance? When will I retire? When will I need this money?”)

A new course of action is only warranted if it is more appropriate than the current path. Evaluating one’s own situation—having the most appropriate asset allocation or glide path and high enough contribution rates—can lead to the most positive actions a participant may take in saving for retirement. Bailing out of the markets and a retirement plan is typically an imprudent action, often detrimental to reaching future long-term retirement goals. Data indicates that individuals attempting to time the market generally proves futile. Current market conditions rarely provide a clear direction as to the future performance of the markets.

The U.S. market, in particular, has been dynamic and resilient in moving on from crisis after crisis throughout history.

The recent market volatility should remind plan participants to focus on what they should be doing on a regular basis: Be mindful of the situation, but diligent about your investment strategy. Participants need to act in their own best interests while the stock market reacts to the current coronavirus and the uncertainty it brings: another bout of expected short-term market volatility.

For more information on staying the course, contact one of our plan advisors.